Restauranteurs often go into the hospitality business because of their love of food and people. That love doesn’t always translate to profits. When a restaurant isn’t making money, it’s an expensive hobby at best or a high-risk financial investment at worst.

What can you do if your restaurant is not profitable enough or at all?

- First, use our 3-step process to increase your financial visibility by focusing on your P&L, conducting routine financial reviews and knowing your costs.

- Then, compare your financial results to restaurant financial benchmarks established by industry experts.

- Finally, we offer 6 ways to analyze your Profit and Loss statement to build sales and profit in your restaurant over time.

Now, let’s get started!

A: Increase Your Financial Visibility in 3-Easy Steps

- Own Your Profit & Loss Statement: Know every line item and what each line represents! Did you know that 80% of most business owners do not know their P&L lines? You are not alone! Get or ask for help if you do not know. Let your pride down and get the help you need to understand your business.

- Schedule Dedicated Time for Financial Reviews: Review every number and every result on regularly scheduled basis – minimally monthly, realistically weekly and ideally daily. Measure, monitor and make adjustments based upon results.

- Know Your Costs: Truly learn every cost of your business. How much does it cost to run your business? Once you know this answer this question – then you will know how much your sales have to be to make a profit!

B: Use these Restaurant Financial Benchmarks as a “Rule of Thumb”

Second, you will want to know how your restaurant financial benchmarks compare to the industry. In this section, we are presenting data from the The Uniform System of Accounts for Restaurants (a guide to standardized restaurant accounting, financial controls, record-keeping and relevant tax matters). If you’re just getting started with restaurant accounting or have questions on how to class expenses and setup your financial statements, this book is a great reference guide!

Remember, Every Restaurant is Unique!

Keep in mind, every restaurant is unique. These benchmarks are presented as a valuable starting point to understand and evaluate the financial performance of your restaurant.

| Full Service | Limited Service | |

| Food Cost | 28% to 32% as a percentage of total food sales. ** | Same as full service. |

| Hourly Employee Gross Payroll | 18% to 20% as a percentage of total sales. | 15% to 18% as a percentage of total sales. |

| Paper Costs | 1% to 2% as a percentage of total sales. | 3% to 4% as a percentage of total sales. |

| Liquor | 18% to 20% as a percentage of liquor sales. | Same as full service. |

| Bar Consumables | 4% to 5% as a percentage of liquor sales. | Same as full service. |

| Nonalcoholic Beverage | Soft Drinks: 10-15% Regular Coffee: 15-20% Special Coffee: 12%-18% Iced Tea: 5% to 10% |

of specific drink type sales. |

| Payroll Costs | 30% to 35% as a percentage of total sales. | 25% to 30% as a percentage of total sales. |

| Employee Benefits | 5% to 6% as a percentage of total sales. 20% to 23% as a percentage of gross payroll. | Same as full service. |

| Management Salaries | 10% as a percentage of total sales. | Same as full service. |

| Prime Costs (COGS + Labor) | 65% or less as a percentage of total sales. | 60% or less as a percentage of total sales. |

| Rent | 6% or less as a percentage of total sales. | Same as full service. |

| Occupancy | 10% or less as a percentage of total sales. | Same as full service. |

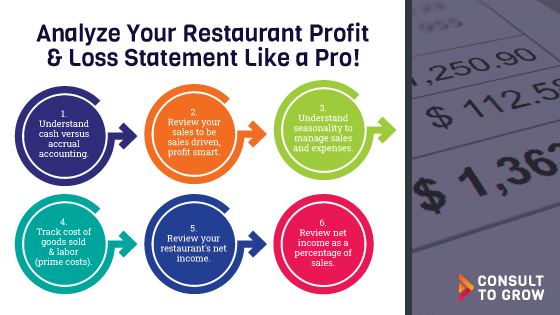

C: Analyze Your Profit & Loss Statement like a Pro!

Reviewing financial statements doesn’t have to be overwhelming. If you are receiving regular financial statements from your accountant, use these six easy steps to review your P&L sheet.

1. Ask if your accountant is using cash or accrual accounting

One important thing to know before you get started analyzing your P&L is whether you are on a cash basis or accrual basis of accounting. With a cash basis, revenue and expenses are recognized when there’s movement of cash (for example, if I agree to pay a vendor $50 for a service in a month, I don’t account for that until the $50 leaves my bank). The accrual method accounts for revenue when it is earned (before the money reaches the bank) and expenses when they are incurred (but before the vendors have been paid).

2. Review Your Sales

This may seem obvious, but you should review your sales first since increased sales is generally the best way to improve profitability. At Consult to Grow®, we continually focus clients on being Sales Drive, Profit Smart. If you see a month was particularly good, try to remember why so you can duplicate what you did in the future. But, try not to cut costs for profit at the expense of getting and keeping more customers and sales! We highly recommend clients use accrual accounting for a more accurate and proper representation of your restaurant’s financial performance.

3. Understand Seasonality

Seasonality is simply the fact that things change based on the season. Seasonality can be seen in many parts of a business including but not limited to both sales and expenses. For example, if you have a busy summer season and slow winter season, you’ll want to manage labor up through the spring shoulder season and manage labor down through the fall shoulder season to maximize your financial performance.

4. Track Cost of Goods Sold & Labor

Next review your Cost of Goods Sold & Labor (together, we call these Prime Costs). It would make sense for Prime Costs to go up as revenue goes up since these expenses are directly related to your product. The opposite would not make sense (COGS & Labor going up as sales go down) and should be a red flag. Additionally, when you review Prime Costs you can ask yourself questions like, “Is there any way I can reduce these expenses?” Finding ways to decrease your Prime Costs will ultimately increase your bottom line and profit margin. Generally, we like to see limited service Prime Costs below 60%, full service below 65%, and fine dining (steak & seafood) below 68%.

5. Review Net Income

Net income is your profit and is one of the most important parts of your business if you want it to succeed and be sustainable over time. You want to see your profit positive (also known as “in the black”) in most cases. Some exceptions where it’s acceptable to see a loss is when the company made a strategic investment during one period to decrease costs or increase sales in a later period.

6. Review Net Income as a Percentage of Sales

Net income is simply your bottom line, but it’s important to do a quick calculation to determine your net income percentage so that you create a baseline and compare “apples to apples” across time periods and across other companies in your industry.

D. Managing Restaurant Financial Fitness

Finally, managing the financial fitness of your business only occasionally is much like attempts to achieve physical fitness through crash diets, impulsive exercise, or other quick-fix methods that rarely work. The financial survival and health of your restaurant will be the result of continuous management and control applied according to a plan.